Are Fidelity’s Zero Expense Ratio Funds For Real?

For the past couple of years, I’ve been acquiring shares of a few Vanguard funds. They are a super-low fee provider and have a diversified set of index funds and ETFs.

It’s all based on my latest strategy of set it and almost forget it investment management. Hey maybe I’ll use this as a future post topic. I’ve even written about some of their funds and ended up buying them.

By the way, I’d like to point out that I am not being compensated in any way by Vanguard for promoting its products or services. I’m simply I fan of Vanguard funds.

So when I heard about Fidelity offering zero expense ratio funds, I had to check them out and see if it’s for real. It turns out they are, but still read on.

How Can Fidelity Afford To Do It?

Fidelity currently offers four types of zero-fee index funds: Large Cap, Extended Market, Total Market, and International.

One reason Fidelity is able to offer zero expense ratio funds because it uses its own index to track the performance of the funds instead of, for example the S&P 500. Fidelity’s Zero index fund, FZROX tracks the Fidelity U.S. Total Investable Market Index. This means it has decided to use a proprietary index for benchmarking FZROX so will not have to pay licensing fees to an index benchmark provider.

How well does FZROX benchmark? Pretty good with a difference of .01%:

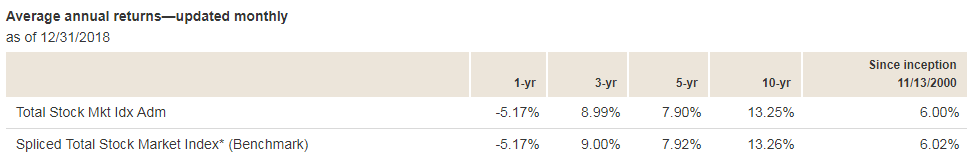

Let’s compare FZROX’s benchmarking to Vanguard’s Total Stock Market Index Fund (VTSAX). It uses a spliced (interconnected) index benchmark.

VTSAX has also followed the benchmark well, with difference of .02%:

And so both FZROX and VTSAX are aligned with the respective indexes they follow.

Another reason Fidelity is able to offer zero expense ratio funds is based on its business model. Fidelity primarily engages in active not passive investment management. That is, only 17% of Fidelity’s assets managed of $2.6 trillion are passively managed. So it can charge higher fees on the remaining 83% or $2.1 trillion it actively manages for its clients.

So whatever it costs to run these zero expense ratio funds is being paid by investors whose money Fidelity is actively managing.

Savings From Zero Expense Ratios Funds

Among other things, in order to see if zero expense ratio funds are worth it, we need to know how much we could be saving right. It’s an obvious question.

How much you can save really depends on how much you invest and for how long. Here are some hypotheticals when comparing FZROX and VTSAX which has an annual fee of .04%:

If you invest $10,000 and earn an average annual return of 10%, 10 years later, you’ll save $95.

If you invest $10,000 and earn an average annual return of 10%, 20 years later, you’ll save $488.

If you invest $10,000 and earn an average annual return of 10%, 30 years later, you’ll save $1,894.

And if you invest $10,000 and earn an average annual return of 10%, 30 years later, you’ll save $6,537.

These savings in fees assumes that the investment return is the same between the two funds.

Plain and simple, the longer your money stay’s invested, the more it will grow and the more you can save by avoiding fees.

Zero Expense Ratio Fund Drawbacks

Open a Separate Fidelity Account

Currently Fidelity’s zero expense ratio funds are not offered on other platforms (e.g., TD Ameritrade or commission free broker Robinhood). These funds are offered only on Fidelity’s platform. Perhaps Fidelity’s move is to get new investors to sign up for these funds using the platform, gain their trust and then later advertise other products and services with attached fee(s).

Zero Expense Ratio Funds Lack Historical Data

There is not enough historical data for me to adequately assess how well Fidelity’s zero expense ratio funds can perform. I prefer to have at least 5 years of data, maybe even 10 to gauge an investment’s performance. These Fidelity funds just started in the second half of 2018.

Now having said that, let’s just see for kicks how FZROX has performed in comparison VTSAX:

As we can see, FZROX is very much in line with VTSAX.

It’s a good indicator that the fund has started off strong and is performing as intended.

Moving Money Means Paying Taxes

If you plan to sell your existing low cost funds and move to Fidelity’s good for you. One expense to consider though is taxes.

If you’ve held your funds for a few years, chances are you’ve earned a decent amount of unrealized gains. Selling these funds to liquidate and move your account means you will have to pay taxes on these capital gains.

For me personally, I do not plan to do so.

Now if I was new to investing, maybe I’d open up an account with Fidelity because of the slight edge of zero expense ratio funds. But it’s a big maybe as the expense ratio is only one factor to consider when deciding between investment funds.

If you do not have a Fidelity account, you can let your current account do its thing and invest new funds into a Fidelity account. Yes you’d have to open a new account, keep tabs on it, and report it for tax purposes. But it would allow you to take advantage of its products without selling off your existing investments from another brokerage account.

Others Will Follow

Since the launch of Fidelity’s zero expense ratio funds, Fidelity has net assets across the four funds total to over $2.6 billion at December 31, 2018. Therefore, I do expect other investment companies to offer zero fee products, if anything purely from a marketing standpoint. After all, the thought of paying zero just sounds good to so many customers.

Join The Discussion:

- Do you own Fidelity’s zero expense ratio funds? How has your experienced been with these investments?

- Do you plan to move to Fidelity’s zero expense ratio funds?

- Are you an index fund investor?

______________________________________________________________________________

I use Personal Capital because (1) it’s free, (2) it tracks all of my accounts and overall net worth, (3) my account balances automatically update, (4) it shows how my investments are diversified and allocated in various sectors, and (5) can use built-in tools like “Investment Checkup” to get….wait for it…free personalized advice!

Check out my simple, yet detailed Personal Capital Review here.

Interesting article. I was not familar with the product. Index funds have become a commodity with cost being the only difference from my perspective. I will stick with Vanguard. The difference in cost is so small it’s not worth the adminstration to me to switch or open new accounts.

Tom recently posted…Procter and Gamble Stock – 62 Years of Dividend Growth

Same here. It’s super competitive within the industry and I’m sticking with Vanguard too due to their history and proven track record.

Very informative article. I jumped onto the FZROX bandwagon when Fidelity started offering HSA accounts. My previous HSA administrator was going to nickel and dime me with fees since I left my job, so switching to Fidelity got rid of all that. Let’s see how it grows my HSA for the future!

As your HSA grows, I envision it will solidify your decision for the change. Thanks for stopping by!