What’s an Index Fund

What if you wanted to find the easiest possible way to enter the stock market? What if you didn’t want to or know how to do detail research on a company? What if you wanted to diversify with the purchase of one financial instrument? What if you didn’t want to pay high fees? What if I said, “yes you can do that”? Well guess what, that’s what I’m saying, YES you can do that….with index funds!

My Introduction to Index Funds

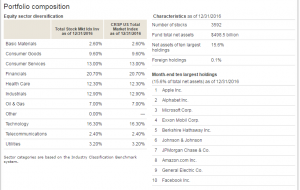

An index fund invests in a whole bunch of companies. An index fund has low fees. An index fund is called an index fund because it follows a stock market index such as the S&P 500 (just look at all the different types of companies within the S&P 500 index: S&P 500 Companies). One example is the Vanguard Total Stock Market Index Fund (symbol: VTSMX). Take a look at this screenshot (click to expand) of its largest holdings as of 12/31/16 (source: Example Vanguard Fund):

As you can see from the right-side, it invests in a lot of major companies (we’ve probably all heard of these 10 companies). On the left side, a decent chunk of the investments is in the financial sector. Also on the upper right-side, you can see that there’s a whole lot of $$$ invested by people into this fund (please note I am not promoting this fund or have any personal or financial gain from communicating about it). I just picked it as an example for this post because it said Total Stock Market Index Fund.

Are Index Funds Risky?

There are some risks to an index fund. One per Kiplinger is that they buy high. When a new stock enters into an index, which can happen several times a year, the stock price typically jumps 10%. This brings another risk that the index you are investing into may not be as fixed as you think. The S&P 500 has about 20 plus changes in companies in and out of the index per year leading to increased transaction costs: Kiplinger on Index Funds.

You may also believe there is a risk of not having control of what is contained in the fund. For example, if you are in an index fund and one of the companies is such you’ve always had a bad experience working with, don’t believe in their product/service, used to work for them but they screwed you over, or whatever reason, you don’t have a say in owning them if you are invested in the fund. Wait, am I taking this to a personal level….hmmmm maybe. We all have had a bad experience with a company. But let me say something else. That doesn’t mean that the company is not good or you should not invest in it. Don’t let investing become personal. Just look at the facts, numbers, senior management profile, projections, and so forth.

Is It Worth It to Buy Index Funds?

For most of us, yes, it’s worth it to invest in index funds. You get automatic diversification which means you spend less time researching the pros and cons of individual stocks, the fees are lower, you can trade them through an online brokerage like Scottrade (https://www.scottrade.com/) or Robinhood (thru your smartphone: https://www.robinhood.com/). Also, you have fewer ups and downs as that compared with buying bare stocks, which means less risk, but possibly less reward too as index funds may not rise as fast at stocks.

Sticking with the example of Vanguard’s index fund above, its largest holding is Apple (AAPL). Per the Google Finance chart below, AAPL has jumped about 20% from Mid-January till now, but the Index fund has remained fairly steady – click to expand.

If you do decide to invest some money in index funds, don’t worry you are definitely not alone. Per Investopedia “[f] or the 12-month period ending May 2016, investors poured more than $375 billion into index funds across all asset classes.

Most of that money came at the expense of actively managed funds, which experienced outflows of roughly $308 billion during the same time frame.” The reason was that index funds did better than actively managed funds in recent years. It goes to show that it’s sometimes just better to leave something alone and let it grow.

So what are your thoughts about index funds? Please share by commenting below.

I exclusively invest in index funds because they are low cost, they “mirror” the market, and I don’t have to do any work to adjust my holdings. I try to mix and match between a few index funds to diversify, but in the end, it’s still investing index funds which have a low expense ratio.

Thanks for sharing SMM, have a good one

I’ve been working on reallocating my portfolio from stock holdings to more index funds. I just need to make a couple more trades and I’ll be more comfortable by having about 70% in index funds. Glad you stopped by!

Good topic to address. I think that once you have spent some time in the PF community you tend to think to quick that this is common knowledge, but come to think of it 4 years ago i had no clue ETF’s existed.

The only thing that worries me sometimes about index investing is the leverage we are handing out to activist investors on the operations of large companies. I guess nothing is perfect.

I didn’t know what they were either until I started working for a financial advisory company back in 2007. But then again, it’s when I actively started managing my own funds so I’m very thankful for that work experience and knowledge acquired.

I am a huge fan of passive index funds. I love the low cost fee approach and not trying to beat the market. I think beating the market is a fools game and I think Warren Buffett’s exercise against the hedge fund shows that even the most brilliant people have difficulty beating a passive index fund.

I wonder statistically how many manager have beaten the market, by how much and how consistently……hmmmm maybe a future post idea!

I like index funds to an extent, they are fantastic for those who may not want to spend the time to research or take on calculated risks with their money. Think financial crisis and any of the banks that tanked. Buying Bank of America when Buffet did was a huge gain for those of us who were willing to take the risk. I personally bought 1000 shares a couple of days before he did because it was to the point where tangible assets were worth way more than the stock price so the risk was worth it for the limited capital deployed and index funds don’t invest in these securities. Thanks for the well written posst!

Thanks for stopping by….and good bet on BOA! Definitely the financial crisis was a buyers market especially if you have the capital to deploy. I think I bought Amazon at that time which ended up being a good decision. But so often we do the opposite (buy when times are good, maybe because it’s hard to throw money at the market when it’s plunging).

I love index fund ETF’s. They are most of our invested assets. The two we mostly own are ITOT and SCHX. We look for those with the lowest expense ratios. It’s worked out well for us over time, just as it should. Every patient stock investor should get rewarded (investor since 1996).

Congrats on your success with ETFs! I’m realizing more about patience every day. I heard about the snapchat IPO this weekend and thought I should buy some shares on Monday. But after reading about it more, I think I will wait until their next quarterly report to see how they did with the new funding.

So few people are able to accurately time the markets. And of the ones who do, they are exceptional rare and typically can only do it accurately for a few years. Index funds seem to take out some of the guesswork for us non professionals. I also like mutual funds with a long and positive track record.

Absolutely! Why bother guessing with partial information when we can diversify into a fund with a history of upside, while paying a minimal fee. I’m definitely not a professional, but I do believe that, generally, past success has a greater chance to be continued.

In terms of the stock market, there really is no better place to invest than Index Funds (for most people). Buying individual stocks is tantamount to hitting the blackjack table – you’re likely to lose. Timing the market is also a great way to get hosed. I think this is what makes so many people afraid of Wall Street – they just don’t understand how to invest properly. All folks really need to know is Vanguard VTSAX. Buy it, add to it, hold it for decades and let the growth shock you.

Yes! No need to be greedy, there is plenty of returns out there for all of us. Index funds do well over the long-term and most of us are long-term investors anyway so might as well buy into a nice big reputable fund VTSAX is great!

I’m also a huge fan of index funds… life it’s a little bit more enjoyable since I’m investing this way. Don’t have to worry about the next big thing. Just maintaining my asset allocation.

Stay the course.

You said it! Staying the course, it’s good because you don’t have to keep selling and buying something else. You can just continue to invest in the same fund or funds and know that your money is being allocated to your liking.

I’m a fan of index funds because of their simplicity and because they have a great track record. But I can’t help but try my hand at a little day trading on the side. 🙂 I have a Vanguard account and I can transfer money and purchase stock through their smartphone app pretty quickly.

So far my results with day trading are…predictably not very good. 😉

I did day trading for like a week many many years ago and quickly learned it’s not for me. Once in a while I’ll buy a new stock, but after a lot of research. Since I’m in it for the long haul, I might as well buy and hold going on past history that the value of the stock or index fund will eventually rise. Best of luck on your day trading though and I hope you fare better than I did!

Love your article SMM. Index funds are definitely worth buying – we will be making them a part of our strategy going forwards 🙂

Tristan

Best of luck to you. The only drawback is the commission to sell some things you have and buy into the funds, but I treat that as part of re-balancing.